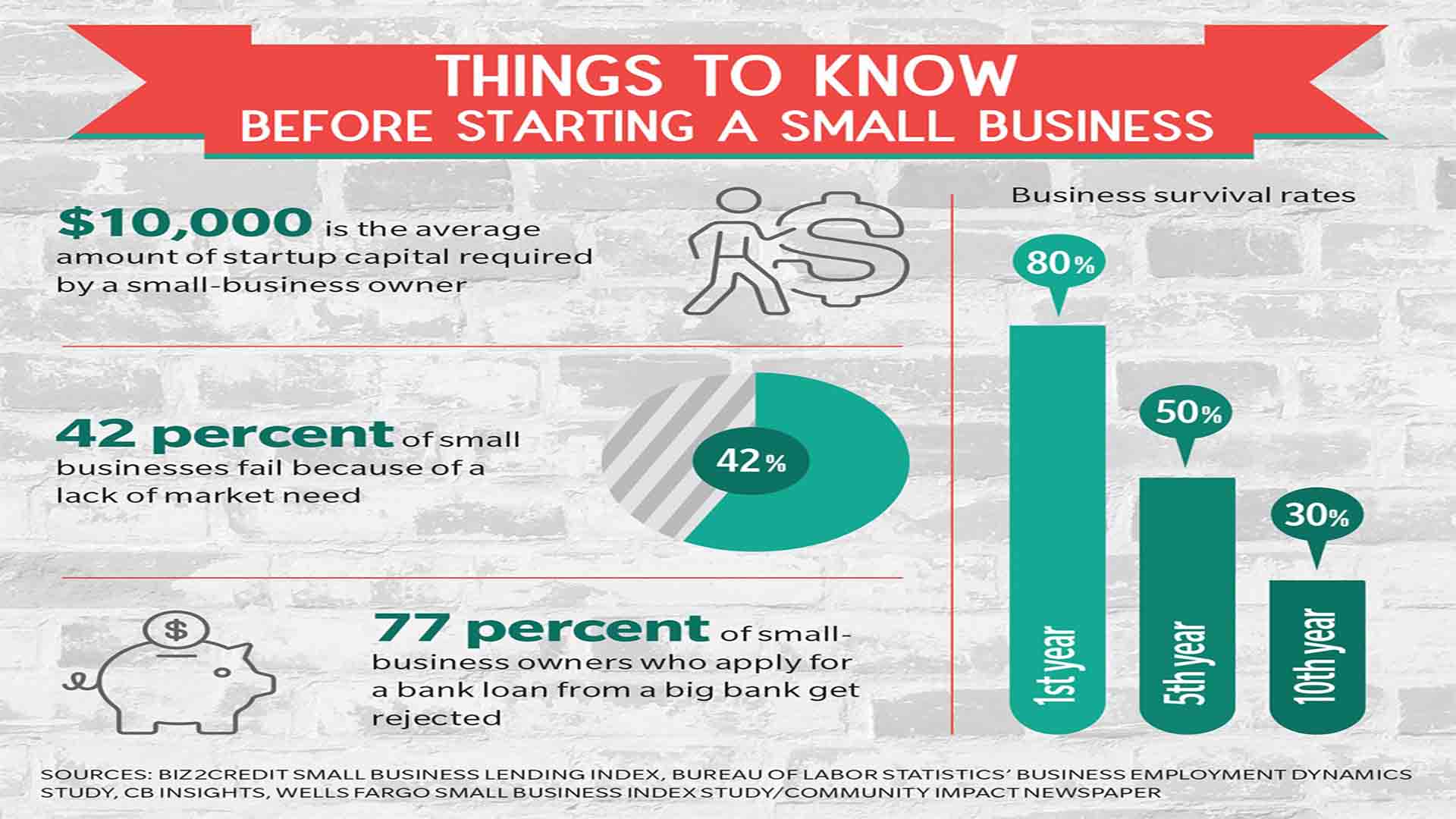

Budgeting is regularly an undertaking that is certifiably not a key focal point of little and fair size organizations, yet it ought to be. Why? All things considered, in particular, the procedure sets you up to answer the accompanying inquiries concerning business plan budget what the following a year will resemble for your business:

- What are your anticipating deals to be one year from now?

- Is it true that you are anticipating that edges should improve?

- Do you intend to enlist extra workers?

- Will you have any enormous capital uses soon?

These inquiries (and numerous others) are average of speculators, money related establishments, and potential key accomplices and monetary purchasers. Each business, paying little heed to their size, ought to have these answers so they can design the yearly spending plan in like manner.

If you are overpowered by the budgeting procedure, or simply don’t have the foggiest idea where to start, underneath are a few hints to enable you to begin with the business plan budget:

1. Counsel All Departments

The budgeting procedure ought not to be finished in secret in an office by an individual from the bookkeeping or account group. Rather, the majority of the offices inside the organization ought to be counselled on their desires for the accompanying financial year.

Business plan budget incorporates the business group who can help with reasonable income appraisals, the assembling or administration group who can educate on expenses regarding conveyance and any huge buys required to refresh hardware, the examination and improvement group who can talk about expected costs just as the planning on any new items foreseen, etc.

Contrasted with making a spending that gauges a general rate increment over the earlier year’s genuine pay – which is dreadfully normal in most little and moderate size organizations – consolidating contribution from every office will result in increasingly exact and complete projections for the forthcoming monetary year.

2. Gauge Revenues

Expected business plan budget (counting representative headcount), yet can be trying to precisely extend. Here are a few different ways to think of the best gauge:

- Consider the ongoing month to month development rate experienced by the organization and choose if that can be proceeded.

- Survey industry guides and other master distributions that attention on your industry and audit budgetary data from some of your rivals, if accessible.

- Speak with your present clients to more readily comprehend their normal needs of your item or administration.

- As referenced above, talk about normal deals with your business office. This could likewise be a decent chance to set desires which will at last assistance decide remuneration for this office.

3. Decide Expenses

When the normal income figures are assessed, the business plan budget can be moved towards the costs. Here are a few contemplations:

Image source: www.ufile.ca

- A few costs relate legitimately to income, regardless of whether they be stock or worker administrations. Ordinarily, the gross edge of a business does not vary considerably except if new items are created, stock evaluating changes or efficiencies are distinguished in the assembling procedure. Utilize this opportunity to move your representatives to distinguish cost reserve funds identified with the conveyance of items or administrations.

- Different costs are fixed costs, for example, lease, protection, leases, and certain different administrations acquired. These costs might be simpler to appraise; be that as it may, thought ought to be made to audit arrangements set up, particularly around protection. Utilize this opportunity to decide whether better protection rates are accessible or maybe various inclusions would be progressively worthwhile.

- Representative pay ought to dependably be built up to be in-accordance with incomes and related development later on the year. Numerous organizations trust that all workers require yearly raises, however on the off chance that outcomes demonstrate a compression in the business, at that point, it may not be sensible. Think about binds parts of remuneration to the development of the organization.

- Alongside remuneration, assessing representative headcount is a basic part of the planning procedure. It is critical to distinguish when you should contract, to what extent that employing procedure takes, and what experience level would advance the activities.

Also, Read: Top 5 creative ways to get funding

4. Distinguish Capital Expenditures

Regularly not considered in the planning procedure are those enormous or costly buys which are essential to the proceeded with the accomplishment of the business. These may incorporate new PCs, frameworks, hardware, vehicles, furniture, and so forth. It is essential to remember that each new representative employed will probably require a specific measure of capital consumption or business plan budget.

Interests in hardware or procedures that are legitimately identified with your item or administration ought to likewise be considered. Will you have to buy any new gear one year from now? Is there old gear that should be refreshed? Maintaining a strategic distance from interest in gear can affect your yield, quality, or conveyance timing, which can straightforwardly affect your incomes.

5. Compute Cash Flow

While it is incredible to have the option to assemble an anticipated salary articulation, it is similarly as significant – if not progressively significant – to compute the normal income of the business via business plan budget.

Image source: due.com

These can be distinctive thinking about that you may pay your bills quicker than your clients pay theirs or you may need to buy stock well ahead of time of offers if obtaining time is noteworthy. An income explanation can be made utilizing the salary articulation just as AR/AP turnover rates and different measurements from the asset report.

6. Be Conservative

While it might appear to be invaluable to indicate financial specialists that the organization will altogether develop, in the long run, a genuine business plan budget may stand for disillusion.

Far more detestable, business choices may have been made utilizing such projections. If all else fails, it is a smart thought to be increasingly traditionalist and leave some “slack” in the projections on the off chance that business objectives are not come to or are postponed.

7. Begin Early and Screen, Evaluate and Reforecast

Organizations should start the yearly planning procedure by October to enable adequate time to guarantee the best-point by point gauge is finished by year-end. In any case, a yearly business plan budget ought to be checked and refreshed on a progressing premise, so it’s never past the point where it is possible to begin.

Image source: wikihow

When you complete the planning procedure, the greatest error you could make is to record it just to haul it out again toward the finish of the next year. A financial limit ought to be checked on a month to month premise, or now and then even on a week by week reason for littler organizations. Business plan budget ought to be altered if conditions change.

Besides, business plan budget ought to dependably be contrasted with genuine outcomes to comprehend why there are contrasts. This will help screen going through cash consistently and help the board settle on key choices in connection to the business.

Scheduling frontward…

Several analytics departments will help manage your organization through the yearly business plan budget procedure. They with your supervisory crew to make a financial limit for your business and screen that spending limit consistently.

Image source : wikihow

This would incorporate breaking down the planned versus genuine outcomes on a quarterly premise and aiding forecast appropriately. They can likewise perform industry and economy surveys to help with the forecasting procedure and give benchmarking information.

Recent Comments